The New York DFS Mandate: A Deadline That Can’t Be Missed

New York has long been at the forefront of cybersecurity regulation. The New York Department of Financial Services (NYDFS) Cybersecurity Regulation (23 NYCRR 500) requires covered financial institutions: including banks, insurance companies, and other financial services firms to implement strong cybersecurity controls.

One of the most urgent requirements is multi-factor authentication (MFA). By November 1, 2025, all regulated entities must have MFA enforced across:

- All privileged accounts

- All remote access into systems

- Any access to nonpublic information (NPI)

The DFS has made it clear: firms that are not compliant by this deadline face regulatory penalties, increased oversight, and reputational damage.

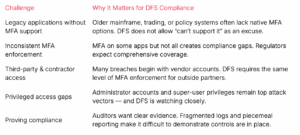

Why MFA Compliance in New York Is So Challenging

Financial services firms in New York are encountering several common obstacles as they race toward the November deadline:

How Unixi Simplifies Compliance for NYDFS MFA

Unixi was built for highly regulated environments like New York’s financial services industry. Here’s how we help you cross the compliance finish line, on time:

- Universal MFA Across Every Application: Unixi enforces MFA across any browser-based app, even legacy or SaaS apps that don’t natively support it. No integrations, no APIs, no vendor cooperation required.

- Privileged Account Protection: With Unixi, every privileged login is wrapped with MFA and logged, satisfying DFS requirements and strengthening defense against insider or credential attacks.

- Third-Party Access Controls: Vendors and contractors can be onboarded with strict MFA enforcement and monitored access, ensuring DFS compliance doesn’t stop at your employee base.

- Audit-Ready Visibility: Our centralized dashboard provides full MFA enforcement reporting across your environment, so you can easily demonstrate compliance during NYDFS audits.

- Adaptive MFA With Minimal User Friction: By leveraging contextual authentication (device, location, behavior), Unixi ensures compliance without frustrating users, increasing adoption and reducing workarounds.

Why Acting Now Matters

The November 1, 2025 deadline is closer than it seems. Large institutions may need months to remediate MFA gaps across sprawling environments, and smaller firms may underestimate the time needed to deploy and test solutions.

The DFS has shown in past enforcement actions that it will not hesitate to levy penalties against firms that miss compliance milestones. Acting early ensures:

- No last-minute fire drills

- Time to resolve complex legacy integration issues

- Smooth rollout and user training

- A strong compliance posture before regulators come calling

Why Choose Unixi for NYDFS MFA Compliance?

Unixi is uniquely positioned to help New York financial services organizations because:

- We require no application integration – enabling MFA coverage even for legacy and SaaS apps outside your IdP.

- We cover 100% of browser-based access – ensuring no compliance gaps.

- We deliver instant visibility – making it easy to prove MFA is enforced everywhere it’s required.

- We balance security with usability – encouraging compliance while minimizing disruption.

Preparing for November 1, 2025

If you are a covered entity under NYDFS 23 NYCRR 500, now is the time to ensure your MFA strategy is airtight. Unixi can help you identify gaps, enforce MFA universally, and prepare the audit trail you’ll need for regulators.

Don’t wait until October. By then, it may be too late.

Contact Unixi today to schedule an assessment and see how we can help you meet New York’s MFA mandate — well before the November 1, 2025 deadline.